Administration

Administration

Here you will find the information you need to administer your MERS Health Care Savings Program.

Resources to Assist with Submitting 2023 1094-B and 1095-B Forms

2023 IRS Instructions to Complete and Submit Forms 1094-B and 1095-B

Instructions for Using the Affordable Care Act Information Returns (AIR) System

(Note: This is an IRS system and MERS is unable to offer technical assistance when using the system)

MERS’ legal counsel has determined that the Health Care Savings Program may qualify as minimum essential coverage (MEC) under the Affordable Care Act (ACA) and therefore should be reported to the IRS using forms 1094-B and 1095-B. Only those participants who have access to their account for qualified medical expense reimbursements – generally this refers to terminated participants or their beneficiaries with an account balance – need to be reported using these forms.

What does this mean for you?

Employers who sponsor such programs are required to file a 1094-B Transmittal of Health Coverage Information Returns form (one per municipality) and a 1095-B Health Coverage form (one for each terminated employee or beneficiary) with the IRS.

Important Deadlines

- February 28, 2024 (if filing by paper) or April 1, 2024 (if filing electronically)

- Deadline to file completed 1094-B and 1095-B forms with the IRS.

- Please note: Beginning in 2024 (for 2023 tax filings), employers required to file 10 or more information returns must file electronically. The 10-or-more requirement applies in the aggregate to certain information returns that are original or corrected returns. Accordingly, a filer may be required to file fewer than 10 Forms 1094-B and 1095-B, but still have an electronic filing obligation based on other kinds of information returns filed. The electronic filing requirement does not apply if you request and receive a hardship waiver. The IRS encourages employers to file electronically even if filing fewer than 10 returns.

- March 1, 2024

- Deadline to post notice to municipality’s website or intranet OR provide a completed 1095-B form to terminated HCSP participants/beneficiaries with an account balance.

- October 15, 2024

- Date when notice can be removed from website or intranet

Important Information on Providing 1095-B Forms to Individuals and Beneficiaries

Previously, all employers were required to provide a completed 1095-B Health Coverage form to each of their terminated employees (or their beneficiary) who have an HCSP account balance. The IRS changed this guideline for tax year 2019. Employers are not required to take the above action if they meet the following two conditions:

- By March 1, 2024, post a notice prominently on the municipality’s website or intranet stating that eligible individuals may receive a copy of their 2023 Form 1095-B upon request, accompanied by an email address and a physical address to which a request may be sent, as well as a telephone number that eligible individuals can use to contact the employer with any questions; AND

- Furnish a 2023 Form 1095-B to any eligible individuals upon request within 30 days of the date the request is received

The IRS has developed the following guidelines for posting the notice mentioned above, including language that must be used, formatting guidelines and posting timelines:

- The provider must provide clear and conspicuous notice, in a location on its website that is reasonably accessible to all responsible individuals, stating that responsible individuals may receive a copy of their statement upon request. The notice must include an email address, a physical address to which a request for a statement may be sent, and a telephone number that responsible individuals may use to contact the provider with any questions. A notice posted on a provider’s website must be written in plain, non-technical terms and with letters of a font size large enough, including any visual clues or graphical figures, to call to a viewer’s attention that the information pertains to tax statements reporting that individuals had health coverage. For example, a provider’s website provides a clear and conspicuous notice if it:

- Includes a statement on the main page—or a link on the main page, reading “Tax Information,” to a secondary page that includes a statement—in capital letters, “IMPORTANT HEALTH COVERAGE TAX DOCUMENTS”;

- Explains how responsible individuals may request a copy of Form 1095-B, Health Coverage, (or, for an applicable large employer member that sponsors a self-insured group health plan and makes a return in accordance with Regulations section 1.6055-1(f)(2)(i), explains how non-full-time employees and nonemployees who are enrolled in the plan may request a copy of Form 1095-C, Employer-Provided Health Insurance Offer and Coverage); AND

- Includes the provider’s email address, mailing address, and telephone number.

- The provider must post the notice on its website by March 1, 2024, and retain the notice in the same location on its website through October 15, 2024.

- The provider must furnish the statement to a requesting responsible individual within 30 days of the date the request is received. To satisfy this requirement, the provider may furnish the statement electronically if the recipient affirmatively consents.

Other Important Reminders and Tips

- MERS will continue to provide you with the data necessary to complete the forms in your secure Employer Portal should participants request this information. We will alert you when this information becomes available in December.

- Employers are not required to complete both Part II and Part III on each form – the Tip on page 6 of the Instructions for Forms 1094-B and 1095-B booklet states:

“Employers reporting self-insured group health plan coverage on Form 1095-B, except for an individual coverage HRA, enter code B on line 8, but don’t complete Part II. If you entered code B for self-insured coverage, skip Part II and go to Part III.” - When completing the 1095-B form, MERS encourages employers to speak with their tax consultant(s) to confirm the sections of the form apply to their municipality. MERS does not know this information.

- The information on the form should be completed by the Employer (Employer name, address and Employer Identification Number are required on the form). MERS does not know your EIN.

- HCSP is not health coverage; it is a reimbursement arrangement and is considered “employer sponsored” for the purposes of minimal essential coverage.

Frequently Asked Questions

- Do I need to report for Medicare-eligible participants?

- No. Medicare exempts from reporting for employees who are over age 65; thus, these participants do not need to receive a form.

- Why don’t I need to report for my active employees?

- The Health Care Savings Program is not considered MEC for active employees because they are not eligible to access their account.

- Why am I receiving data to report for someone who is not a former employee?

- The report you receive in the Employer Portal will contain the data of anyone who is eligible to use their HCSP account balance for qualified medical expenses and the months in which they were eligible and/or carried a balance. This could be a former employee from your municipality OR their beneficiary. MERS’ legal counsel has advised that it is lawful for employers to have access to beneficiary data for the purpose of filing a 1095-B form on their behalf.

- I provided retiree health insurance for employees or COBRA in 2023. DO I need to file for those retired employees?

- If you provided retiree health insurance or covered former employees under COBRA for their 2023 filing, you do not also need to file a 1095-B on behalf of those former employees. One filing per Social Security number is sufficient. If the retiree or terminated participant is not participating in another health insurance option, or is not taking COBRA, then the employer should file a 1095-B form on behalf of that former participant. It is not enough to just offer COBRA or a health insurance plan; the participant must have been covered under COBRA or the health insurance plan during the 2023 filing year in order to not file a 1095-B on behalf of their behalf.

MERS requests that employers report wages and contributions for employees enrolled in the Health Care Savings Program.

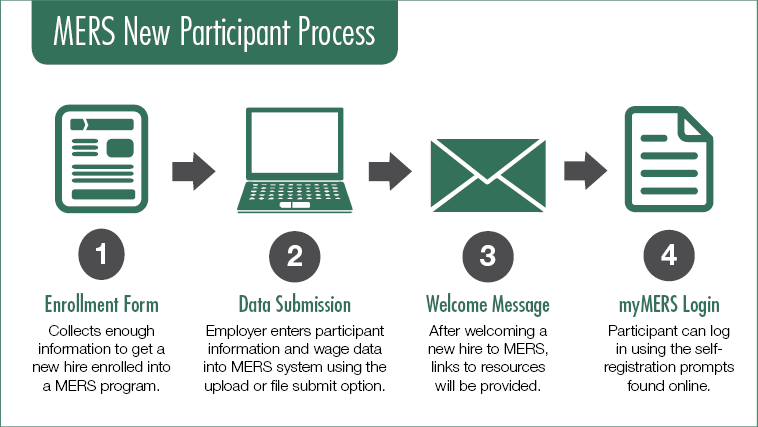

Here’s what your new hires can expect when you enroll them in a MERS plan:

![]() Health Care Savings Program Enrollment Form

Health Care Savings Program Enrollment Form

Within two weeks of enrolling, new hires they will receive:

- A welcome email introducing MERS and giving an overview of the plan(s) your new hire is enrolled in, along with immediate action items. Included in this email will be a link to the

MERS New Participant resource page. Here, new hires can find:

MERS New Participant resource page. Here, new hires can find:

- Plan information

- Video explaining plan features

- Information on the benefits of a myMERS account

Important! It is highly encouraged that you submit an email address for your new hire upon enrollment in order for MERS to generate a welcome email for your new hires. If you do not include an email address, your new hires will continue to receive welcome kits via postal mail within six weeks of enrollment.

* New hires who are new to a MERS product will receive a product welcome letter.

As your partner, we want to ensure your plan is in compliance with IRS guidelines. Leave conversions are all or a portion of unused leave payouts that are contributed annually or at separation of employment.

Upon adoption, your municipality may have chosen to offer a leave conversion lump sum into HCSP. In order for your plan to maintain its tax-qualified status, contributions must be mandatory. Employees cannot choose how they receive their leave conversion. However, each division may define its own payout option.

If you are currently offering a lump sum amount for leave conversions as an optional benefit to your employees, it is recommended that you immediately stop. Administering your plan in this manner violates the tax-free nature of the program and may require those contributions to be taxable income reported on an individual’s W2.

If you are seeking a flexible option that allows your employees to choose how they receive leave conversions, consider amending your HCSP agreement and utilizing the MERS 457 Program. Contact your Benefit Plan Coordinator with questions or for more information.

If an employee separates service before meeting vesting requirements, forfeited employer contributions can be used in three different ways:

- Used to offset future employer contributions

- Deposited into your MERS Retiree Health Funding Vehicle account

- Spread across all participants within the division, as determined by your participation agreement

If a former employee is re-employed, forfeited employer contributions may be reinstated according to his or hers division’s agreement and specified period of time.

If there is a change in employment status, please notify MERS through the Employer Portal as soon as possible. You can do this at the Participant edit screen, or by uploading the status on the Report. Status options are as follows and are noted by the numeric symbol which corresponds to that applicable status to be used in the file: Active (A), Inactive (I), Terminated (T), Medical Leave (M).

You would use this status for the following reasons:

Active

Used for new hires and existing employees who are actively employed, in situations where someone is rehired, and when a participant is restarting contributions

Inactive

Used when a participant is on military leave, when they have opted out of participation but have not left employment, when they are on leave for medical reasons, or if a participant’s employment status has changed that makes them no longer eligible to participate

Terminated

Used when the participant is no longer actively employed, if they are on disability and do not expect to return, or if you are notified of death (if the status reflects terminated, a date of termination must be on file)

Medical Leave

Used when a participant is on medical leave but has not terminated employment – the program allows for reimbursement of medical expenses once the participant has been on medical leave for six months or longer.

This occurs when a participant has separated from employment and returns to work. For the Health Care Savings Program, this can have different meaning based on the terms of their rehire.

For example;

- If the employee returns to work in a job title that participates in the Health Care Savings Program as a benefit, the individual should be “rehired” in the employers’ next contribution reporting following their rehire date. The participant will not be able to use their account for reimbursement once rehired into the employer and their debit card will be shut off.

- If the employee returns to work in a job title that does not participate in the Health Care Savings Program, the individual may continue to use their account for reimbursement of medical expenses.

Instructions for updating employment status in the employer portal can be found in the Wage and Contribution Guide (pdf). The individual cannot be actively receiving pre-tax contributions from their employer and eligible to use the account for post-employment medical expenses at the same time. If you have questions, please contact your Benefit Plan Coordinator for questions.

One of the most important things employees can do for themselves and their family is to name a beneficiary. Equally important is to make sure beneficiary information remains up-to-date. Employees can name their beneficiaries and update contact information through their myMERS account.

Please note: If employees choose to make these updates by completing the Health Care Savings Program Beneficiary Designation Form (Form MD-103). If you receive any completed beneficiary forms, you should upload and send them to Alerus through the Employer Portal. For instructions on how to upload and submit documents, please see page 18 of the Wage, Contribution, and Employer Portal Guide (pdf).

There are two types of beneficiary designations for HCSP: Primary Beneficiary and Contingent Beneficiary.

There are special instructions if you plan to continue contributing to your employees’ HCSP account post-employment:

- Use the upload spreadsheet (.csv) to enroll your retirees. All required census information must be included to ensure MERS is appropriately communicating with retirees, including instructions on using their account. The following information is necessary to create that enrollment:

- First/Last Name

- SSN

- Date of Birth

- Address

- Original Date of Hire

- Date of Termination

- Participant status on the upload file must indicate “T” for terminated (Column O)

- Subsequent reporting through upload format for retirees should continue to include their date of termination and appropriate employment status (reporting through manual reporting will not require any changes to status)

- Note: where an employer plan offers a varied contribution based on single or married status, only the former employee is eligible for enrollment (no second record is created for the spouse)

Employees are eligible to use their HCSP account when they separate from employment (separation can be for any reason, not just for retirement).

When an employee is reported as “terminated” to MERS, we mail them a letter and other resources that help your employees understand how to use their account.

Sample materials:

Additionally, following verification of eligibility, they will receive a letter from Alerus with two Health Benefits debit cards which can be used to make qualified medical expense purchases. This option is great when paying for prescriptions at a pharmacy or co-payments that aren’t adjusted after the point of sale.

Please note – per Internal Revenue Service regulations, most debit card transactions will require participants to submit documentation verifying that the purchase was an eligible expense. Typically the documentation needs to include the following information:

- Provider Name

- Service(s) Received or Item(s) Purchased

- Date of Service

- Amount of Expense Incurred

There are no federally mandated contribution maximums for the Health Care Savings Program.

Reminder! MERS continues to pay the Patient-Centered Outcomes Research Institute (PCORI) fee, as required by the Affordable Care Act, on your behalf. This fee funds research to understand consumer health decisions. We will pay this fee on your behalf through 2029, when the requirement to pay this fee ends. We are pleased to provide this service in partnership with our employers.