The Municipal Employees’ Retirement System (MERS) of Michigan is an independent, professional retirement services company that was created to administer the retirement plans for Michigan’s local units of government on a not-for-profit basis.

Our mission is to partner with those who serve Michigan communities to provide retirement benefits and related services to support a secure retirement.

MERS listens and works in partnership with municipalities to deliver superior value to our members. We proudly serve more than 140,000 participants, including local firefighters, nurses, and the men and women who plow our roads and keep our communities safe.

Independent Elected Board

MERS is governed by an elected board that operates without compensation. Our board is committed to accountability and transparency, holding the line on costs, and watching out for the best interest of our members.

![]()

Click here to learn more about the MERS Retirement Board.

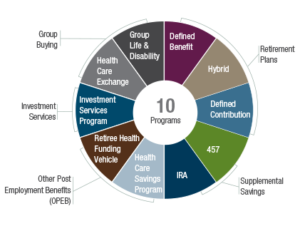

A Program for Every Need

An attractive retirement package can help employers recruit and retain top talent. At MERS, we recognize that every member has unique needs and we offer a broad range of customizable plans to fit those budgets, goals and priorities.

Learn more about each of MERS’ programs.

Investing in Retirement

The MERS Defined Benefit Portfolio is a completely diversified fund utilizing various management strategies to provide downside market protection with upside market participation. MERS consistently outperforms its benchmarks and market averages with a prudent, long-term approach designed to generate reasonable growth and income while minimizing risk.

Our participant directed accounts offer a streamlined investment menu, with select investment options that allow individual participants to design diversified portfolios that match their investment needs.

Law and Regulation

![]() MERS must follow Michigan state law and prudent standards of diligence. We maintain strict oversight and management. Our assets are invested in accordance with the Public Employee Retirement System Investment Act (PERSIA). MERS conducts quarterly compliance reviews.

MERS must follow Michigan state law and prudent standards of diligence. We maintain strict oversight and management. Our assets are invested in accordance with the Public Employee Retirement System Investment Act (PERSIA). MERS conducts quarterly compliance reviews.

Investment Earnings

![]() For over 20 years, more than half of pension benefits paid have come from MERS’ investment earnings, not taxpayer dollars.

For over 20 years, more than half of pension benefits paid have come from MERS’ investment earnings, not taxpayer dollars.

Readying Michigan for Retirement

MERS is dedicated to helping employers and participants understand their MERS benefits and to providing the right resources to prepare for retirement.

Financial Wellness

![]() MERS defines being financially well as managing your day-to-day spending, controlling debt, having money set aside for an emergency, and having a financial plan for the future. Taking control of finances for both the present and future increases the likelihood of a successful and enjoyable retirement, and relieves the stress and burden that financial uncertainty can cause. MERS provides participants with access to a free Financial Fitness tool account that helps them track their financial wellness.

MERS defines being financially well as managing your day-to-day spending, controlling debt, having money set aside for an emergency, and having a financial plan for the future. Taking control of finances for both the present and future increases the likelihood of a successful and enjoyable retirement, and relieves the stress and burden that financial uncertainty can cause. MERS provides participants with access to a free Financial Fitness tool account that helps them track their financial wellness.

Opportunities to Learn More

![]() Participant education is a priority at MERS, and it’s always free. In addition to attending benefit fairs and providing customized onsite and/or virtual group presentations, MERS provides 1-on-1 consultations with participants to ensure they understand their plans. MERS also offers free events delivering expert guidance on various topics ranging from understanding your benefits, to Social Security, to health care in retirement.

Participant education is a priority at MERS, and it’s always free. In addition to attending benefit fairs and providing customized onsite and/or virtual group presentations, MERS provides 1-on-1 consultations with participants to ensure they understand their plans. MERS also offers free events delivering expert guidance on various topics ranging from understanding your benefits, to Social Security, to health care in retirement.

Online Account Access

![]() myMERS, our free, secure online account access, offers personalized guidance and up-to-the-minute account information to help participants maximize their benefits and stay on the right retirement track.

myMERS, our free, secure online account access, offers personalized guidance and up-to-the-minute account information to help participants maximize their benefits and stay on the right retirement track.

myMERS App

![]() The myMERS app is available for both Apple and Android devices and puts the convenience and full transactional capability of participants’ myMERS accounts in the palm of their hands.

The myMERS app is available for both Apple and Android devices and puts the convenience and full transactional capability of participants’ myMERS accounts in the palm of their hands.

MERS Service Center

![]() In addition, our knowledgeable Service Center staff are available weekdays to provide individual assistance via phone call, live online chat and by appointment.

In addition, our knowledgeable Service Center staff are available weekdays to provide individual assistance via phone call, live online chat and by appointment.

Fiduciary Responsibility

Click here to learn more.

View our “Your Partner in Retirement” brochure

![]()

View our corporate video

View all videos