How do I log into the Employer Portal?

- Log into the Employer Portal at www.mersofmich.com.

- Select Defined Benefit Employer Portal in the left navigation.

Two-Factor Authentication

The Employer Portal requires two-factor authentication (2FA), where a code is sent via text or phone call to verify your identity. This extra layer of security protects you by making it more difficult for someone to gain unauthorized access to your account.

If you do NOT know your username, please contact our Service Center at 800-767-6377.

Resetting Your Password

Once you set up your account with 2FA, you will be able to reset your password by clicking on the “Forgot Password” link. You will then be prompted to enter your username. A verification code will be sent via email. On the Reset Password page, you will enter your username, the code you received via email and your new password.

How do I make a correction to a submitted report?

The portal allows for two types of corrections:

- Corrected Monthly Report – when corrections are needed to multiple employee records

- Corrected Employee Report – when a correction is needed to a specific employee’s record

When submitting a wage/contribution correction for an employee, the full corrected amount must be reported for the month you are correcting (do not just report the difference).

Note: Whether you are initiating a ‘Correct Monthly’ report or a ‘Correct Employee’ report, you’ll want to:

- Ensure the correct period has been selected

- Locate your employee(s) to correct, then follow the below guidelines for data entry.

For detailed instructions on how to correct a report, see the “Correcting a Report” section of the Defined Benefit Portal User Guide.

How do I report a leave of absence?

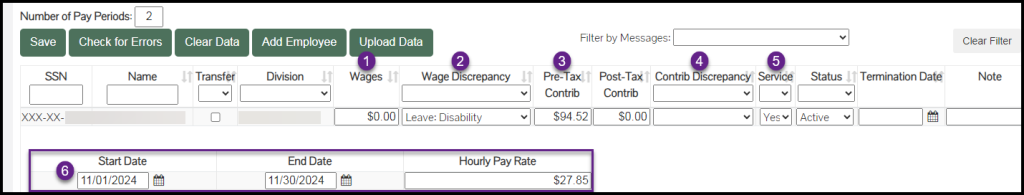

To help MERS staff easily determine which months of the employee’s wages to skip when calculating their final average compensation amount, please be sure to update the following fields:

- In the Wages column, do not include any third-party wages for leaves of absence.

This means you should only include any employer-paid wages issued to the employee while they were off on leave (i.e., includible lump sum payouts, used benefit time PTO/sick pay, and any wages earned by the employee while intermittently working). - In the Wage Discrepancy column, select the most applicable “Leave” code (do not select “Miscellaneous”).

If you are reporting a leave type whereby there is no code to describe the leave (i.e., union business, administrative, unpaid, suspension, parental, or educational), select the “Leave: Other” wage discrepancy code and include the type in the provided field. If you are reporting a “Leave: Other” that is not listed under the division’s provisions, MERS is not aware of such leave. Please contact your Benefit Plan Coordinator to make an addendum modification to align our records with your practice. - In the Pre(Post)-Tax Contribution column, enter applicable contributions.

This is based on reported wage OR if zero wages with service credit included using the formula [service credit qualification (hours adopted) x employee’s pay rate x employee’s percentage rate (adopted for division) = employee contributions due] for each month of leave. - Select “Misc. Contribution Discrepancy” to explain any variance between the wage and contribution amounts reported. When a code is selected, a Note is required to explain the variance, for example, “formula used”.

- In the Service column, select “Yes” if service credit will be included or “No” if the service is excluded (based on the division’s benefit provisions which can be viewed in the left navigation menu in the employer portal).

Military leaves are governed by the Plan Document, Section 8 and the Uniformed Services Employment and Reemployment Rights Act of 1994 (USERRA). Please view the DB Employer Portal Guide for instructions on how to report a qualified military leave of absence to MERS. - In the fields provided, enter the dates the employee was absent during that reporting period along with the pay rate.

If you selected the “Leave: Other” code, please also specify the leave type in the description field.

(click image to see a larger version)

Video Resources:

How do I report a terminated employee?

- Change the employee’s status to terminated and enter their termination date.

- You will then be prompted to enter their final wage payout information. If final wages have been issued, uncheck the “Report Final Wages Next Month” box (this will remove the employee from your monthly report) and enter the applicable information. If final wages have not been issued, keep the box checked to complete reporting on this person next month.

Note: This allows MERS staff to reach out to the employee and explain how to use their account once they have left employment. Employees must have a terminated status for MERS to process refunds.

How do I report an employee who transferred divisions?

Check the transfer box and select the employee’s new division.

Note: This ensures employees have the correct provisions applied to their accounts and that any applicable employee contributions are calculated based on the new division’s rate in effect.

How do I report an employee who fell below the service credit qualification requirement?

Change the service to No and select the proper wage discrepancy code to explain why.

For example, did the employee change status and they are no longer eligible, or did they go on a leave of absence or intermittent leave? All wages paid to eligible employees must be reported monthly (regardless of service earned). Contributions are withheld based on reported wages.

Note: This helps MERS understand why no service was earned for an eligible employee and ensures only those who meet the service credit qualification requirement get credit for this month of work.

How do I report final wages for a terminated or retired employee?

In order to report a separation of employment a termination status is required. For detailed instructions on terminating an employee and reporting with final wages, see the Defined Benefit Portal User Guide.

How do I remove a terminated/retired employee from my reports?

In order to remove a terminated employee from your reports, you must uncheck the check mark next to “report final wages next month.”

How do I report an employee that worked more hours than normal or received a shift premium or on-call pay?

- Please ensure these wage types are included in the division’s definition of compensation.

- Select “Hours Higher/Lower” under the wage discrepancy codes. In the Notes field, specify the type of wages.

Note: This allows MERS staff to easily verify that the extra wages should be included in the employee’s final average compensation. If the division’s definition of compensation excludes certain wage types, please do not report the wages to MERS.

How do I report employee raises?

Select “Regular Wage” under the wage discrepancy codes.

Note: Whenever there is a fluctuation in an employee’s reported wages (I.e., overtime, lump sum payouts, leaves of absences, etc.), the system will ask you to select a wage discrepancy code to explain the reported variance. By selecting “Regular Wage”, the wage validation used when comparing future reported wages will reset to this new amount you are reporting.

How do I report an employee who received a lump sum payment?

- Select “Lump Sum Payment” under the wage discrepancy codes.

- Enter payment type and payment amount. If “Other” is selected as a type, include a description in the field provided.

![]() Video Resource: Lump Sum Payment Reporting (2:55 runtime)

Video Resource: Lump Sum Payment Reporting (2:55 runtime)

Note: Some employers have elected to only include certain wage types as reportable wages for the employee’s final average compensation. Please review the division’s definition of compensation and only report includible wage types to MERS. If the wage type paid is not part of the division’s definition of compensation, do not report it to MERS.

If the employee receives a lump sum retro wage adjustment, ensure to select “Retro Wage Split”. Then in the Notes field, include the retro type, amount, and period. This allows MERS to spread the retro wage issued over the appropriate period.

How do I locate rates?

You can locate your rates through two different options:

- Expand the division lines in your open monthly report.

- Look in the statement section of your Annual Actuarial Valuation.