How It Works

How It Works

The MERS Defined Benefit Plan (DB) is a qualified retirement plan under Section 401(a) of the Internal Revenue Code, offering your employees a secure lifetime benefit that does not fluctuate with investment gains or losses.

Formula

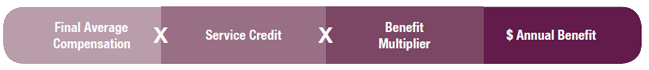

Eligible employees earn a retirement benefit based upon a three-part formula.

The DB formula is determined by multiplying an employee’s final average compensation (FAC) by years and months of service (service credit) by a benefit plan multiplier (established by the employer). Then that number is divided by 12 to determine the monthly (Straight Life) benefit amount.

View Formula Details

Final average compensation (FAC)

The average of the highest consecutive wages over a defined period of time as determined by the employer, usually three to five years.

Service credit

The total amount of qualified periods of work, including any purchased service credit. Employees earn service credit for each month of work that meets the employer’s requirement. For more information view the Service Credit Purchase page.

Benefit multiplier

The benefit multiplier ranges from 1.0% to 2.5%, and is chosen by the employer. Multipliers of 2.25% and higher have a maximum benefit of 80% of FAC.

Funding The Plan

Defined benefit plans can be funded by three sources: employer contributions, employee contributions and earnings on investments. Watch ![]()

![]()

![]()

In a defined benefit plan contributions vary from one year to the next. Watch ![]()

![]()

![]()

Plan Advantages

There are many benefits of the MERS Defined Benefit Plan.

![]()

![]()

The MERS Retirement Board assumes the role of plan fiduciary for the defined benefit plan. Your interests are our number one priority when it comes to making decisions affecting the plan. As plan fiduciary, MERS saves your municipality time and resources by handling all of the due diligence surrounding fund selection, monitoring and compliance.

The MERS Defined Benefit Portfolio is a well-diversified portfolio that provides downside market protection with upside market participation. MERS Target Asset Allocation policy has three main goals: capital preservation, capital growth and inflation protection.

![]()

![]()

As a multiple-employer plan, MERS creates economies of scale by pooling together assets for investment purposes. As our customers continue to grow, the assets we manage for you grow. This allows you and your employees the benefits of an over $11 billion dollar pool, including keeping costs low as well as access to trusted MERS funds and other publicly traded mutual funds.

![]()

![]()

Fiduciary Responsibility

![]()

![]()