Did you know that kids as young as three can grasp the concept of how money works? And yet, most graduate high school without ever taking a course on financial basics. That leaves us – parents, grandparents and influential adults – to teach children the importance of budgeting and saving. During this session, we’ll review key concepts to teach at every age level and provide some tips and resources to help you get started. If you have younger people in life that you care about, don’t miss this session.

Health care costs are one of the biggest expenses in retirement. Do you know your options? During this video, MERS staff will provide an overview of Medicare and the benefit options you’ll have in retirement. We’ll talk about the costs associated with Medicare and provide you with resources to help you get more information. We’ll also highlight the MERS retiree healthcare exchange and talk about how you can use the MERS Health Care Savings Program in tandem to assist with premium costs.

Financial wellness is a buzzword in the financial industry today, but what does it really mean? This video take a deep dive into the four pillars of financial wellness – budgeting, emergency savings, debt management and planning for the future. You’ll learn more about each of these topics and walk away with practical and applicable skills and action items you can use to improve your overall financial health.

Personal finance experts tell us that ideally, we should have 3-9 months’ worth of expenses saved in an emergency fund. It’s also recommended that we save for retirement, so we can replace 80% of our pre-retirement income. For most of us, there is only so much money to go around. During this video, we’ll explore different savings options and strategies to help you plan for the unexpected, while still saving for retirement.

Don’t forget to let us know who your beneficiaries are so that your retirement benefits are handled smoothly without red tape, expense or delay. MERS makes it easy to update beneficiary information through logging in at mersofmich.com.

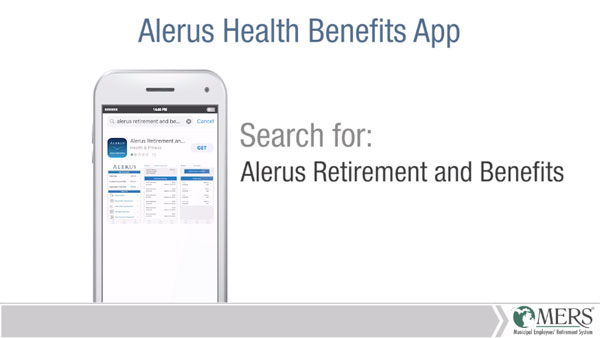

Now that you’ve left your employer, you — and your spouse and other dependents — can use your MERS Health Care Savings Program account for tax-free medical expense reimbursements. This video explains how to access the Alerus Benefits App and manage your claims.

This video will provide valuable information and insight on how your plan works. You can expect to walk away with more information on the components that make up your defined contribution plan, the importance of designating beneficiaries and keeping them updated and your investment options. We’ll also discuss the benefits of myMERS and how the resources MERS provides help you stay on track to meet your retirement goals.

Are you within five years of retirement and have questions about the MERS Defined Benefit retirement process? This video reviews the steps you should take now to prepare for your retirement.

As a new MERS participant, you may have questions about how your benefits work. We’ve made learning about your new plans easy. This short, interactive video lets you pick which MERS programs you would like to hear more about.

Did you know that if you don’t pay Social Security taxes on your earnings AND you are eligible for Social Security benefits, the formula used to figure your benefit amount may be reduced? This is known as the Windfall Elimination Provision, or WEP.

Additionally, if you receive a retirement or disability pension from a federal, state, or local government based on your own work for which you didn’t pay Social Security taxes, the Social Security Administration (SSA) may reduce your Social Security spouses or widows/widowers benefits. This is known as the Government Pension Offset, or GPO.

If you will be affected by either of these provisions, this video hosted by Vonda VanTil, a Public Affairs Specialist with the SSA will walk you through WEP and GPO in detail and provide resources to help you better understand your Social Security options.