Administration

Administration

Here you will have access to the processes you need to interact with MERS.

MERS requests that employers report wages and contributions for employees enrolled in the MERS 457 Program.

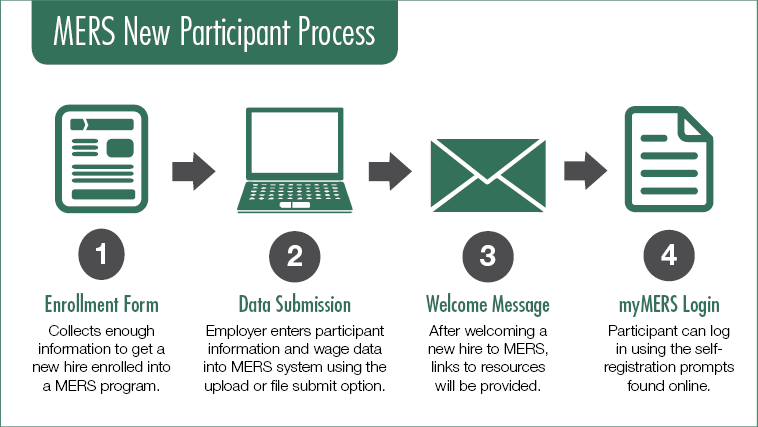

Here’s what your employees can expect when you enroll an existing employee or new hire into the MERS 457 Program:

Within two weeks of enrolling, the employee will receive:

- A welcome email introducing MERS and giving an overview of the plan(s) the employee is enrolled in, along with immediate action items. Included in this email will be a link to the

MERS New Participant resource page. Here, they can find:

MERS New Participant resource page. Here, they can find:

- Plan information

- Video explaining plan features

- Information on the benefits of a myMERS account

Important! It is highly encouraged that you submit an email address for your new hire upon enrollment in order for MERS to generate a welcome email for your new hires. If you do not include an email address, your new hires will continue to receive welcome kits via postal mail within six weeks of enrollment.

* Existing employees who are new to a MERS product will receive a product welcome letter.

Changes to employees’ voluntary deferral rates in 457 must be collected by the employer and according to employers’ internal procedures. Employers will adjust the contributions reported to MERS as a dollar amount in the “pre-tax” source of contributions in the upload template. MERS does not store or receive the deferral rate for this program.

For details on modifying your template, please review the![]()

![]()

![]()

![]()

![]()

![]()

The “regular” or “pre-retirement” 457 catchup provision allows employees to make up for contributions not made in prior years.

Participants must complete the Contribution Catch-Up Form (Form MD-414). Employers maintain a copy for their records.

Specific requirements must be met, including:

- Participant must to eligible to participate in the current 457 deferred compensation plan any time from January 1, 1979, to the present, and are currently participating in the plan.

- Participant did not defer the maximum amount allowed by law in one or more of the years since being eligible to participate and since 1979.

- Participant plans to retire this year or plans a retirement date within three years of this Special Catch-Up begin date.

The “Age 50” Catch-Up Provision allows employees reaching age 50 or older during the calendar year to contribute an additional amount. This additional annual contribution is not dependent on any prior year’s deferrals to a 457 program. No form is required, individuals work with their employer to make associated catch-up contributions.

Employers make adjustments to the pre-tax contributions during regular wage and contribution reporting. At year-end, if contributions exceed maximums, you may be asked to provide a copy of the Special Catch-Up form for reference, if one is not on file.

One of the most important things employees can do for themselves and their family is to name a beneficiary. Equally important is to make sure beneficiary information remains up-to-date. Employees can name their beneficiaries and update contact information through their myMERS account.

Please note: If employees choose to make these updates by completing the Beneficiary Designation Form (Form MD-703). If you receive any completed beneficiary forms, you should upload and send them to Alerus through the Employer Portal. For instructions on how to upload and submit documents, please refer to the Wage, Contribution, and Employer Portal Guide (pdf).

The view IRS-established retirement plan contribution limits and reporting data for the current year, click here (pdf).

Disability, whether duty or non-duty related, is defined as a physical or mental impairment rendering an employee permanently incapable of performing gainful activity for which they are suited. If an employee ends employment due to a disability, they will have access to pre-tax, employer and Roth contributions.

To request a distribution from their account, they must complete and submit the 457 Distribution Form (Form MD-405), along with evidence of the disability, for review and approval. MERS will process the request, upon your approval (as the employer). The same procedure is required for distributions of any Roth contributions they may have.