Administration

Administration

Here you will find the information you need to administer your MERS Defined Benefit Plan.

View our dedicated report wages and contributions page for the Defined Benefit Plan.

The MERS Defined Benefit Plan allows participants to earn service credit for each month of eligible work. With the approval from the employer, participants can purchase service credit to help them meet early retirement eligibility or increase their pension. Unlike MERS-to-MERS or Act 88 time, purchased service credit cannot be used to reach vesting. For more information on service credit purchases or to submit a service credit purchase request on behalf of an employee, click here.

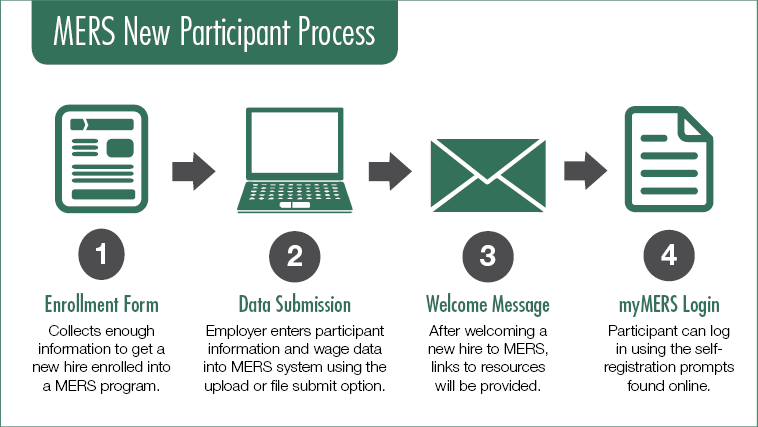

CONNECTING YOUR NEW HIRES WITH THEIR MERS BENEFITS

Here’s what your new hires can expect when you enroll them in a MERS plan:

Within two weeks of enrolling, new hires they will receive:

- A welcome email introducing MERS and giving an overview of the plan(s) your new hire is enrolled in, along with immediate action items. Included in this email will be a link to the MERS New Participant resource page at mersofmich.com/life-events/new-Participant. Here, new hires can find:

- Plan information

- Video explaining plan features

- Information on the benefits of a myMERS account

Important! It is highly encouraged that you submit an email address for your new hire upon enrollment in order for MERS to generate a welcome email for your new hires. If you do not include an email address, your new hires will continue to receive welcome kits via postal mail within six weeks of enrollment.

* New hires who are new to a MERS product will receive a product welcome letter.

Rehired employees (that are not considered “retirees” for purposes of MERS Defined Benefit) are placed in the open active plan even if it is different from the plan they retired from. Please refer to the “New Hire” section on this page for more information.

When you have an employee transferring from one division to another, the standard rules place them into the active plan at the time of a transfer. Treating transferred employees the same will provide consistency and effortless recordkeeping during transitions. Your municipality may adopt the plan continuation rules using the Employer Resolution Establishing a Uniform Transfer Provision.

Standard Transfer Rules and Plan Continuation Rules

Under the Standard Transfer Rules, if an employee transfers from one division to another, they must participate in the open, active retirement plan of the new division. Under the Plan Continuation Rules, the employer will enroll a transfer or rehired employee into the closed plan that is the same plan type as the plan the employee transferred from (or was formerly enrolled in), whether open or closed, if such plan exists. When both open and closed plans of that type exist, the employee will be enrolled in the open plan. If the same plan type does not exist, the employee is enrolled in the open plan for that division, regardless of plan type.

Under either rule, where a plan offers an option in employee contributions, the plans’ default rate will apply to the returning or transferring employee.

A Participant Transfer Certification form is required regardless of which rules are adopted. Employers may adopt the Plan Continuation Rules by Resolution Establishing Uniform Transfer Provision.

Transfer Form

If you have an employee that retires and later decide to return to the workplace, there are restrictions that can affect their MERS pension under certain conditions. These restrictions apply only if they become re-employed by the same employer they retired from. There are also different rules for elected officials than regular employees. There are no restrictions if they are hired anywhere other than the employer they retired from.

If the employee retires and returns to a regular (non-elected/appointed) position, the following rules apply:

- They must complete and submit the Working in Retirement Certification (Form F-29c), signed by both the employee and the employer, to MERS.

- They must have a bona fide termination before returning to work, per IRS rules. Bona fide termination is defined as no formal or informal agreement to return to work prior to retirement.

- They must have 60 days of separation.

- The requirement allowing rehired retirees to work up to 1,000 hours in a calendar year has been waived through December 31, 2027. This means that currently there is no limit to the amount of hours they may work each year.

If an employee retires and returns to an elected/ appointed position, the following rules apply:

- They must complete and submit the Working in Retirement Certification (Form F-29c), signed by both the employee and the employer, to MERS.

- They must have a bona fide retirement before returning to work, per IRS rules. Bona fide retirement is defined as no formal or informal agreement to return to work prior to retirement.

- If they are re-elected/appointed into the same position, they must have two years of separation.

- If they are elected/appointed into a different position, they must have 60 days of separation.

- They are not subject to any hour limitation.

To retire an employee in the DB Plan:

- Have the employee apply for retirement online through their myMERS account, within 45-90 days of their retirement date. MERS will then send your HR contact the employer certification of termination form for completion.

- Follow the steps below to change their employment status to “Terminated”. Once the application has been received, MERS will update the employee’s status to “Retired”.

To terminate an employee in the DB Plan:

Complete and send the Certificate of Termination form (F-29b) to MERS.

Change the employee’s information in your report to us:

Monthly report:

Note: This is your normal monthly report that contains all of your employees. If you need to make a correction, see the section below on corrected reports.

- Log in to the MERS Employer Portal.

- Click “Defined Benefit Employer Portal” from the left side navigation bar.

- Under the “Wage Reporting” tab, Click “Prepare Report”.

- Change status for the employee that is terminating employment to “terminated”.

- Enter the date of separation.

- A final wages row will appear below the employee. The box for “Report Final Wages Next Month” is automatically checked so that they will be on next month’s report for you to report final wages and payouts. If you are able to pay them all final wages and payouts during the month of termination remove the check mark. This will enable the boxes for each type of payout: Longevity, vacation, PTO, etc.

- Complete the monthly report for all your employees enrolled in Defined Benefit as you normally do each month. Save and submit the report.

Corrected report:

If you have already submitted the monthly report and need to terminate an employee, follow these steps.

- Log in to the MERS Employer Portal.

- Click “Defined Benefit Employer Portal” from the left side navigation bar.

- Under the “Wage Reporting” tab, Click “Make Corrections”.

- Click on “Correct Employee Report”.

- Search for the participant by entering last name or SSN and clicking on “Search”.

- Click the green box to the left of the participant.

- The corrected report for the individual will open. For “Backdate Termination” select the correct month and enter the day.

- At the top of the report you will now see the final wages row below the month you selected.

- The box for “Report Final Wages Next Month” is automatically checked so that they will be on the next month”s report for you to report final wages and payouts. If you were able to pay them all final wages and payouts during the month of termination remove the check mark. This will enable the boxes for each type of payout: Longevity, vacation, PTO, etc. If you need to report final wages in the next month leave the check mark.

- Save and submit the report

For employees who have two defined benefit plans from two different employers, MERS-to-MERS time will automatically be applied after one year.

Employees who would like to verify MERS-to-MERS time for inclusion in DC service should contact the MERS Service Center at 800.767.MERS (6377) or fill out and submit the MERS-to-MERS Service Verification Form (form MD-016). MERS-to-MERS time will only apply before a DC distribution is taken or a forfeiture occurs, ensuring that employers will not incur future liabilities.

One of the most important things employees can do for themselves and their family is to name a beneficiary and keep the information updated. After being enrolled in the MERS Defined Benefit Plan and the activation of their online myMERS account, participants are urged to log in and provide beneficiary information. MERS helps them remember this step through an informative welcome message sent directly to them after account activation and monthly beneficiary reminders for six months or until those designations have been completed.

There are three types of beneficiary designations: Monthly Pension Beneficiary, Primary Refund Beneficiary and Contingent Refund Beneficiary. Unless otherwise specified, the spouse is always the Monthly Pension Beneficiary and the Primary Refund Beneficiary. If the spouse chooses to waive their rights, it must be in writing by signing the spousal consent of forfeiture the DB Beneficiary Change Request Form (Form #F-21).

The Employer Portal provides a summary report of your employees’ beneficiary information. Please use this to help identify and follow up with those who may be lacking designations or updated details.

There are two types of MERS Defined Benefit Plan disability retirement: Non-duty disability and duty disability. Employees may apply for disability retirement benefits if they have incurred a total and permanent disability while actively employed. Terminated employees must submit an application for disability retirement within two years of their termination date, providing their injury or illness was the reason for their termination.

To apply for disability benefits, the employee or employer should:

- Complete and submit the Application for Disability Retirement (Form 51).

- Current medical records will need to be submitted to MERS with the application, including two separate Physician’s Statements. If the illness or injury was a result of a work-related cause MERS will need a copy of Employer’s Basic Report of Injury and all documents relating to worker’s compensation. Please review the instructions on Form 51 for further details. If the employee has terminated their employment, we will request the employer to confirm the participant’s employment ended as a direct result of an incapacitating physical or mental condition.

- The application and any medical documentation will be evaluated by Managed Medical Review Organization, Inc. (MMRO), MERS’ disability vendor. The employee will be contacted by MMRO within 5 business days of receiving the application to discuss next steps in the disability evaluation process. The evaluation process may take up to 3 months to complete. Delay in receiving the employee’s medical documentation may increase the evaluation processing time. In addition, if medical documentation is not received, it could result in cancellation of the claim.

- We will notify both the employee and employer of the results once the disability evaluation is complete. If the application is approved, the employee will be eligible to apply for retirement benefits. The disability approval letter will detail next steps in order to start collecting a benefit.

For more information on disability retirement, please consult the ![]()

![]()

![]()

![]()

![]()

![]()

![]()

To view IRS-established retirement plan contribution limits and reporting data for the current year, click here (pdf).

You can change the method in which you pay your monthly invoices for open defined benefit divisions.

- For more information, click here.

- If you would like to change your billing method, click here to access the online form.